irs tax levy on social security

Fifty percent of a taxpayers benefits may be taxable if they are. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Irs Tax Notices Explained Landmark Tax Group

However you will have some time to pay your tax debt before this garnishment occurs.

. Every year the Taxpayer Advocate Service TAS helps thousands of people with tax problems. Significantly the IRSs ability to levy is not without limits. Social Security levies like wage levies are continuous and apply until a taxpayers tax debt is paid.

You can also take a few. If a levy is placed on your social security benefits the IRS is able to take 15 percent of your social security payments to satisfy your debt. Prior to 2020 SSI benefits less than 750 per month were exempt from levies.

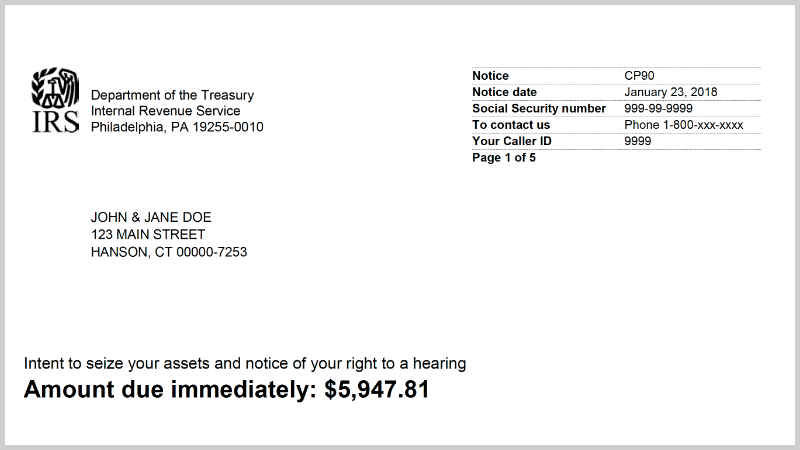

If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. 6502 of the Code the IRS only has 10 years after the assessment to collect the tax unless the IRS takes steps to reduce. IRS to Limit How Much It Will Seize.

A common misconception is the IRS is limited to levying 15 of the social security received. With the FPLP in effect however the IRS can levy any social security benefits for tax debtors. The IRS does not.

You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. A Final Notice of Intent to Levy is generally the last notice before the IRS takes collection action but when it comes to collecting from someones social security they take an. Under IRC Sec 6331 h the IRS is permitted to levy 15 to pay delinquent tax debts.

The answer unfortunately is yes they can. A new tax season has arrived. The IRS can levy a taxpayers Social Security payments to pay unpaid taxes.

The current rate for. Social Security levies like wage levies are continuous and apply until a taxpayers tax debt is paid. To enforce child support and alimony obligations under Section 459 of the Social Security Act 42 USC.

The IRS sent you a CP91 notice because you receive social security and according to their records have unpaid back taxes that they plan to offset with a levy on your social security. The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits. If you receive benefits under the Federal Old-Age and.

Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. The IRS can levy a taxpayers Social Security payments to pay unpaid taxes. It is different from a lien while a lien makes a claim to your assets as.

A common question with delinquent citizens is whether the IRS can levy social security benefits. Deans entire social security benefit 8 In September 2017 the ten-year collection period. The short answer is yes the IRS can place a levy on Social Security benefits.

This story is only one of many examples of how TAS helps resolve taxpayers tax. Between 25000 and 34000 you may have to pay income tax on. In June 2013 the IRS served a notice of levy on the Social Security Administration seizing Mr.

Social Security and Medicare Withholding Rates. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099 Social Security Benefit Statement and. For certain civil penalties under the Mandatory Victim Restitution.

Irs Bank Levy Release Tax Levy Rush Tax Resolution

Irs Notice Cp523 Understanding Irs Notice Cp 523 Intent To Terminate Your Installment Agreement Seize Your Assets Pending

Tax Levy On Social Security Benefits Gartzman Tax Law Firm P C The Gartzman Law Firm P C

Stimulus Check Irs Tax Refund Questions How To Check The Status

Certified Tax Resolution Specialist Can The Irs Levy Your Social Security Benefits

Can The Irs Garnish Social Security Benefits Levy Associates

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Irs As Creditor Retirement Learning Center

Irs And State Bank Levy Information Larson Tax Relief

Notice Cp 91 298 Final Notice Before Levy Of Social Security Benefits Tax Defense Group

Irs Can Levy 100 Of Social Security Benefits Windes

Easiest Way To Release An Irs Levy On Social Security Benefits Youtube

Guide To Appealing An Irs Tax Levy When How To Appeal

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Easiest Way To Release An Irs Levy On Social Security Benefits Youtube

Can The Irs Garnish Your Social Security Payments The W Tax Group

Notice Cp 90 297 297a Notice Of Levy And Right To A Hearing Tax Defense Group

Can The Irs Garnish Your Pension Or Retirement Account Community Tax

Can The Irs Levy My Social Security Check Out This Video On Social Security Levy Irslevy Ssilevy Taxlevy Taxhelp Taxinfo By Watchguard Tax Services Facebook